One Stop Shop (OSS) with WooCommerce

Marc Wagner

June 30, 2021

On 01.07.2021, the One-Stop Shop procedure (OSS) will be rolled out across Europe. This procedure helps to simplify the payment of VAT. Up to now, different thresholds apply throughout Europe, depending on the member state. If you exceed this threshold, you had to register in the respective country in order to pay the VAT there.

What changes? #

With the entry into force of the One-Stop Shop (OOS) procedure, the threshold is uniformly lowered to 10,000 EUR for the calendar year. As long as you do not exceed this value, you can comfortably pay VAT in the country where your business is located.

As soon as you exceed the threshold, you will have to register with the one-stop shop (OSS) in the future. There you can easily declare and pay the VAT due for member states.

How can I customize my WooCommerce store for OSS? #

There is already a suitable solution for this. Vendidero, the developers of Germanized, offer the WooCommerce plugin One-Stop Shop Plugin for WooCommerce for free.

If you are already using Germanized, you can even avoid installing a new plugin. Since 29.06, Vendidero has already integrated the OSS customization into the Germanized plugin.

How can I check if I am affected by the OSS procedure?

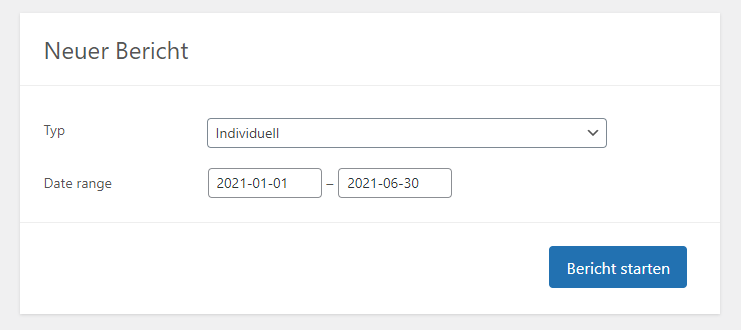

First, you should check if you exceed the threshold. For that, you can simply go to WooCommerce > One-Stop Shop.

Now create a new report starting from 01.01.2021 until today’s date. The report shows you if you already exceed the threshold or how close you are to it.

If you exceed the threshold, an additional registration for the OSS procedure is required. You should do this in time. Additionally, you have to adjust your WooCommerce store. This mainly concerns the tax calculation, but also the price display.

How to customize the tax calculation in WooCommerce

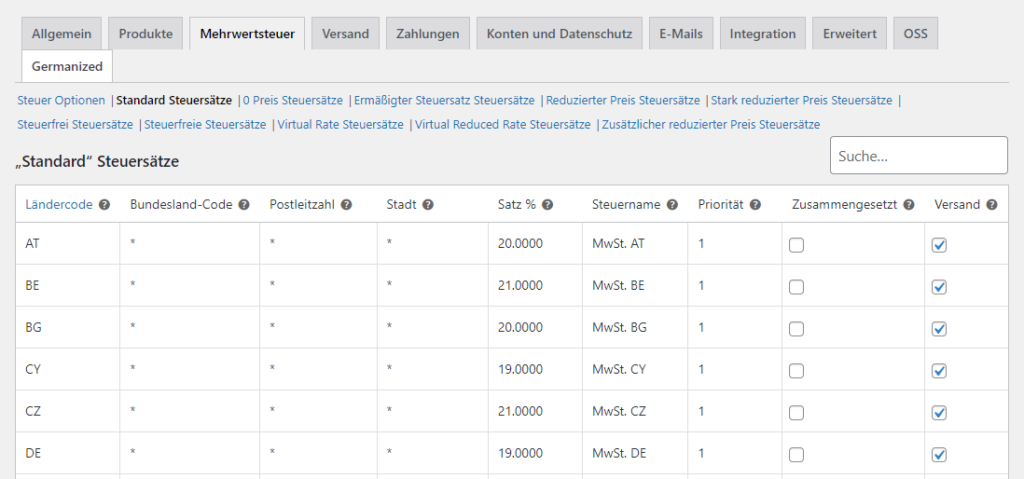

In the settings of WooCommerce > Settings > OSS, you can automate the automatic conversion of the EU tax rates by clicking the Start OSS Share button. Alternatively, you can customize this yourself via WooCommerce > Settings > VAT > Default tax rates.

In addition to the standard tax rates, there is also the reduced tax rate, the higher tax rate and the greatly reduced tax rate. In Germany, there is only one reduced tax rate. Other EU countries have up to two further reduced tax rates.

After importing and participating in the OSS, the amounts in the cash register are calculated based on the standard tax rate. However, conflicts may arise here due to the reduced tax rates.

For example, pet food is taxed at 7% (reduced tax rate) in Germany. In other countries, however, this can be quite different again.

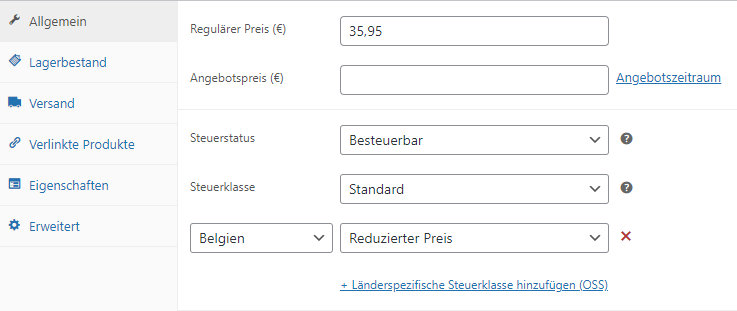

But also here the plugin from Vendidero helps. On the edit view of your products, you will now find a new option that allows you to set different tax classes for different countries.

However, this also means for you that you now have to define the correct tax classes for each product and for each country you sell to (if they are taxed differently).

Create and export reports regularly

For the OSS procedure, the Federal Central Tax Office requires regular reports. These have to be sent quarterly and at the latest one month after the end of the quarter. The One-Stop Shop plugin offers you a simple export in CSV. The net and tax amount for the respective country will be calculated automatically. You can then easily hand over the report to your tax advisor.

Step-By-Step Guide #

- Download One-Stop Shop Plugin for WooCommerce

- Have report created to check if you are affected by OSS procedure (>10,000 EUR, WooCommerce > OSS)

- Perform registration for OSS

- Import tax rates by confirming the Start OSS participation button (WooCommerce > Settings > OSS).

- Add reduced tax rates at product level by tax class and country (Products > Edit > General > Add country-specific tax class (OSS))

- Generate quarterly report and submit to tax advisor. (WooCommerce > OSS)

Artikel von:

Marc Wagner

Hi Marc here. I’m the founder of Forge12 Interactive and have been passionate about building websites, online stores, applications and SaaS solutions for businesses for over 20 years. Before founding the company, I already worked in publicly listed companies and acquired all kinds of knowledge. Now I want to pass this knowledge on to my customers.